How and When to Sell Your NFTs

The Strategy

Knowing when to sell your NFT is a key part of NFT trading. It’s hard to know the perfect moment to sell, but here are some tips for profitable flips.

Have an Exit Strategy

A short term hold lasts roughly a few days to a few weeks. This strategy generally revolves around riding the hype around a certain project. You want to get in early at a good price and sell quickly when interest in the project is peaking. Keep a close eye on the project’s trading volume and number of users for any signs of slowing growth. If you aren’t sure where to check those stats, our Resources page has some helpful links.

Also, frequently check twitter and any other relevant social media or community groups to see the current sentiment about the project’s growth. Are comments positive or negative? Are there more people talking about the project than yesterday or less?

Pricing Strategy

The price you choose when listing your NFT for sale depends on your planned holding period, market trends (see our NFT Trading Strategies Guide for details), seller competition, and how much profit you’re aiming for. Suppose you have an NFT and plan to sell it in about a day. If it looks like comparable NFTs have been selling about five times per day, then you want to set your sale price so that you are within the five lowest offers. Setting your pricing this way is not an exact science and becomes less exact as your time frame becomes longer. The closer to the time you want to sell, the more frequently you should re-evaluate your pricing and be sure to take changes in market trends into account.Before you buy, you should have a loose plan of how much you want to sell the NFT for. Without a plan, it’s difficult to make decisions about selling at a good time. However, it’s usually more important to price based on the reality of how the market changes than to lock yourself into a plan.

There is a relevant theory in behavioral finance called the Disposition Effect, which is the tendency for traders to sell their winning investments too early and hold onto their losers for too long. We’re telling you about it so you can learn to not make these mistakes. If NFT prices are performing better than you initially expected, then you should increase your sale price and if it is performing worse, then you should lower your price and cut your losses. Selling at a loss can be emotionally difficult, but is crucial to do when a trade is not going your way. The value of an NFT can go to 0 and you’re better off getting some money back and reinvesting it in a better opportunity.

Average Out Your Exit

Just like markets for stocks or cryptocurrencies, it’s nearly impossible to sell at the exact peak of an NFT market. Selling everything at the top is an unrealistic goal and you are better off averaging your exit from the market.

This means that if you have multiple NFTs from the same project, you should sell them gradually instead of all at once. This decreases your risk of selling everything too early or holding onto all your NFTs too long. For a short term hold, that may mean spacing out sales by a few days and for a long term hold it could mean selling every few weeks or months.

Fixed Price vs. Auction

The most common way to set your NFT sale price is through a fixed price listing. This just means you put it up on a marketplace at a certain price and wait for someone to come and pay it. This is the default way of selling and what you will likely use most of the time.

The other option is to list your NFT as an auction, specifically a Dutch auction. In a Dutch auction, you set a starting price, an ending price, and an auction duration. Then the price that people are able to buy the NFT for gradually drops from the starting to the ending price over the length of the auction until someone buys it or the auction ends.

Dutch auctions are useful when the market price of a NFT is unclear, allowing you to start the listing at an optimistic price and gradually lower it within an acceptable range. They also work well when you want to liquidate an NFT. Set the price to drop from somewhat low to low and you have a chance at getting a sale on the higher end, which wouldn’t have been possible if you just listed at a low fixed price.

Let’s Sell An NFT on OpenSea for a Fixed-Price

From opensea.io, select your profile image in the top right and then click Profile.

Select the NFT you would like to sell from your wallet. If you don’t have an NFT available to sell, check out our how to buy an NFT resource to get started.

Select Sell on the top right to be taken to the listing page.

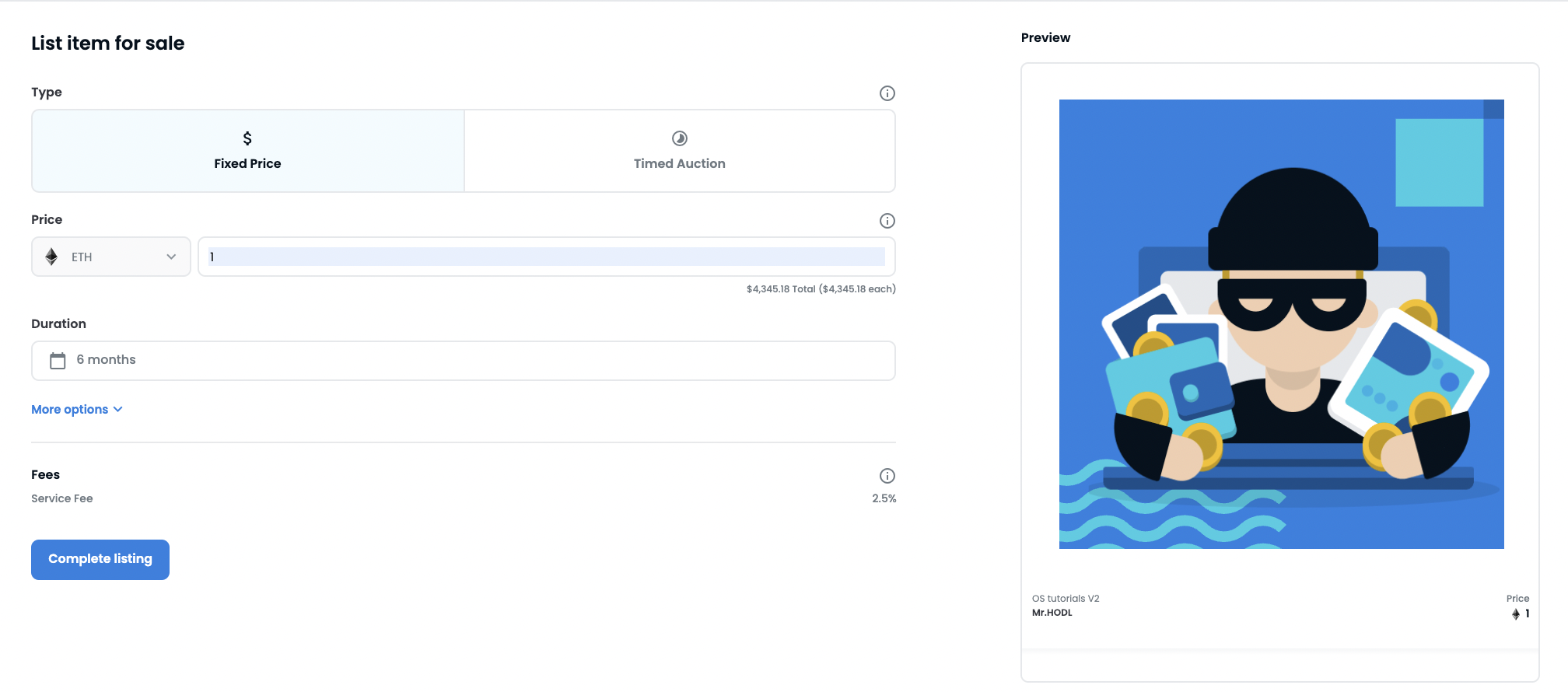

You'll be taken to the listing page, where you can choose the price and type of sale.

A "Fixed Price" sale is one where the price stays fixed. In this screenshot below, the price is fixed at 1 ETH. Click here to learn more about "Timed Auction" sales.

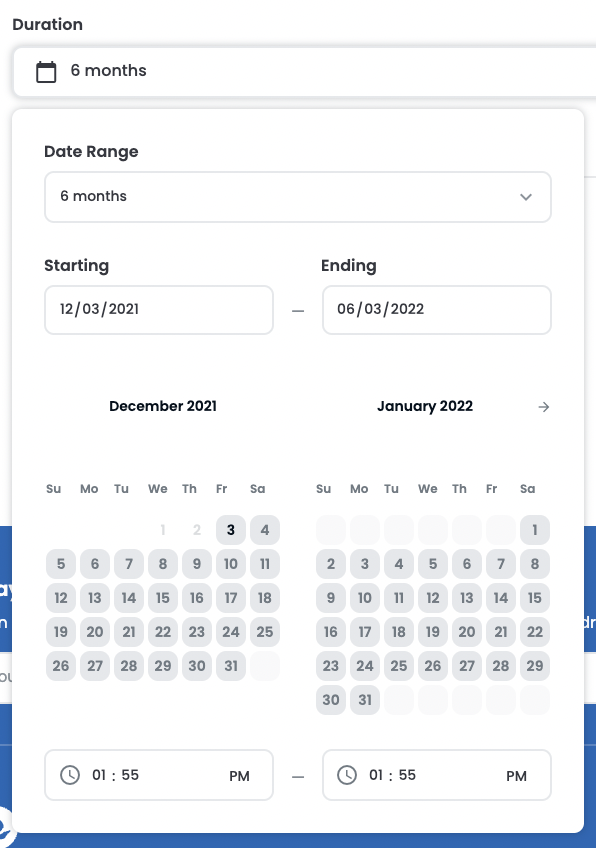

You can also set a duration for the sale. The default options are 1 day, 3 days, or 1 week - but you can also set a custom duration using the calendar.

You can also include the item in a bundle (grouping NFTs from different collections)*.

Lastly, you can also reserve the item for a specific buyer. To do so, simply paste their address into the field below "Reserve for a specific buyer".

Completing your sale

You'll then be asked to confirm your sale by signing a transaction.

Please note, if you’ve never sold on OpenSea before, you’ll need to initialize your wallet first. Also, if the item you are listing was not minted on OpenSea but through a custom contract, there may be an additional approval and signature required to allow OpenSea to trade the item on your behalf.

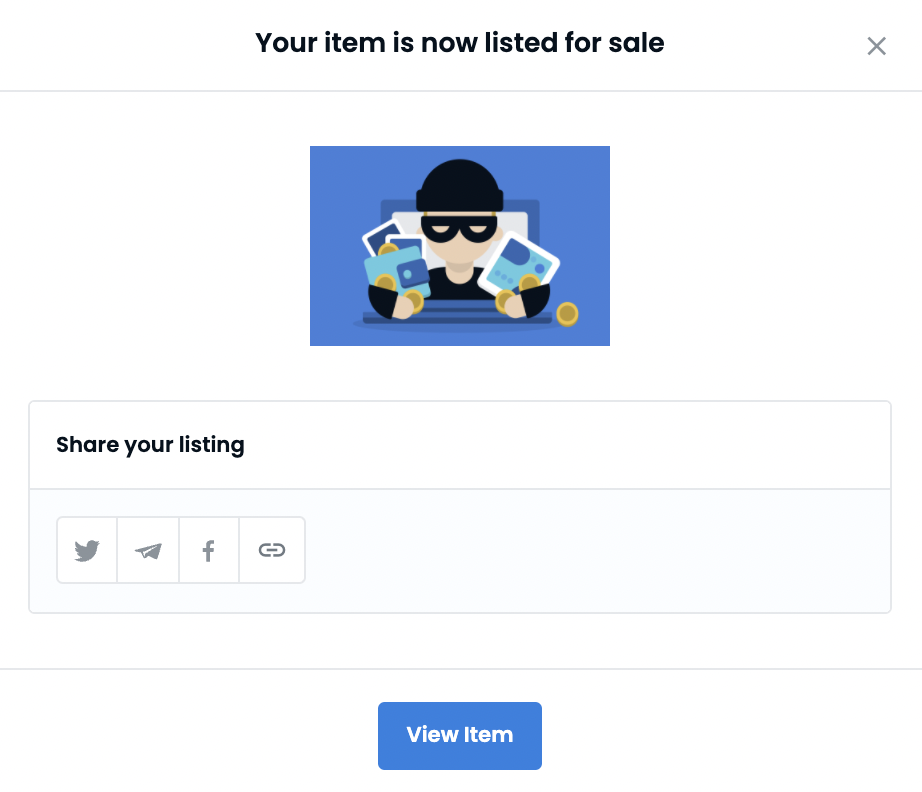

Once your listing is complete, you will get a pop-up confirmation like below. Make sure to share your listing on social media!

To see the items you have listed to sell, from your profile page select the Activity tab.

You will see the item you just listed labeled with the transaction List.